Comparing popular investment platforms

In the UK, there is a big variety of platforms you can use to invest. For example, there's Trading212, Robinhood, eToro, InteractiveInvestor, Coinbase, Crypto.com, and more. Some of the ones I just listed are crypto focused, not investment focused, the difference being that crypto is much more risky, with a low chance of being able to increase your money. On the other hand, investments can increase the money you put in, depending how it's invested.

Trading212

I've already written a post about some of the benefits and downsides of Trading212, but I'll go into further detail in this one.

Benefits

- Deposit whenever

Compared to other platforms, you can deposit whenever you want onto trading212, so that can be 1AM on a Sunday, or at noon on a Tuesday. This makes it much easier to deal with the money you have on the app, as it comes out of your bank account, and straight into Trading212.

- Modern interface

Some platforms have interfaces that feel like they haven't been updated in ages, with commonly accessed pages behind multiple taps, and information you need being near impossible to access. On Trading212, I found it simple to access everything I needed.

- Free to use

There's no fees on deposits, or trading (for UK stocks), other than the legally required ones like stamp duty. For foreign stocks there's a 0.15% FX fee to convert the currency, which also applies to dividends and when you sell the stock, as well as any others, for example the French have a tax on their stocks, so it costs more to buy/sell those, and you get lower dividends.

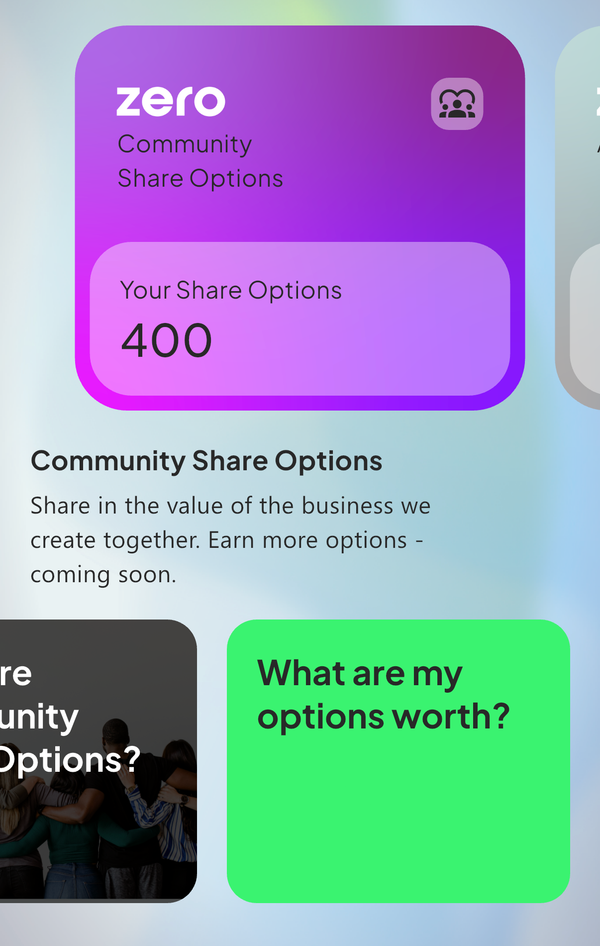

- Great community

The Trading212 community tab has a bunch of communities for every topic you might need, and the people in those communities are almost always extremely helpful.

Downsides

- Lacking details

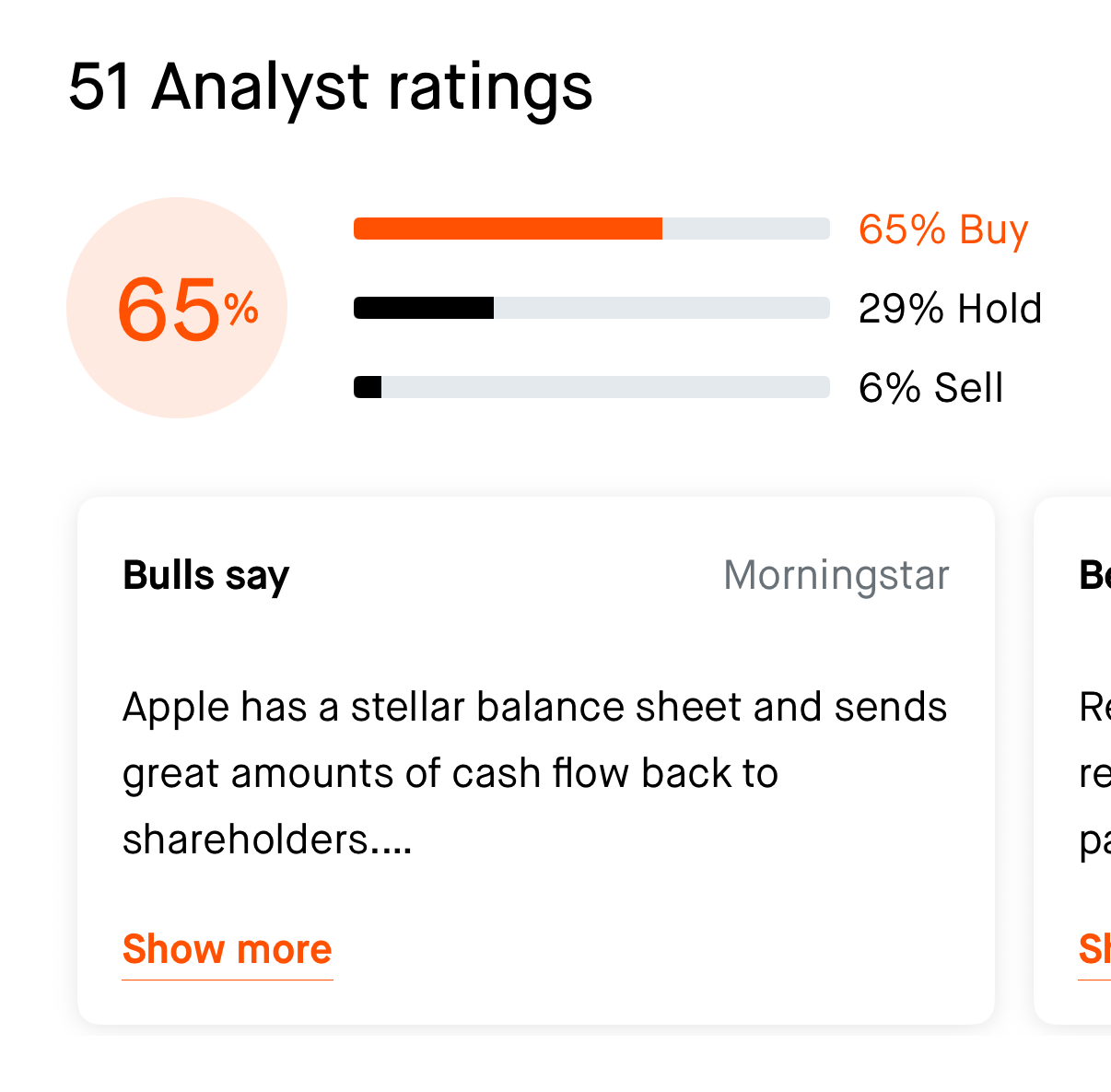

Whilst all the pages you need are easy to access, if you want to access some details, Trading212 might not have them, for example there's no ratings for if you should buy/hold/sell a stock (One of the other platforms has this), but for now, that's the only feature I can think of that it doesn't have.

Robinhood

I've not used Robinhood as much as i've used Trading212, but in my experience it's not a bad platform, it's not the best, but it's also far from the worst. I am a fan of some of it's features, which i'll get into soon. I joined with a bonus where by depositing £1 I got a free fractional share, with mine being worth $7.

Benefits

Robinhood has some benefits, especially compared to other platforms, so i'll list out the most important ones in my opinion.

- Analyst ratings

Underneath some popular stocks, there is a rating for if you should buy, hold, or sell the stock, this makes it very easy to see if it is really a good idea to buy the stock, especially for beginners.

- Shows news related to stocks

Just above the analyst ratings, there is a section for news about each stocks, and the impact on the stocks, making it easy to learn what other investors think about an article.

Downsides

In my relatively short experience using Robinhood, i've found some downsides that i've not really experienced with other platforms.

- Limited deposit hours

You can't deposit whenever you want, when I first signed up for Robinhood it was a Saturday, so I had to wait until Monday morning before my deposit finally appeared in the app. This made it slightly more inconvenient to get started, although it doesn't make a massive difference as you can't purchase stocks on weekends anyway.

- No ISA accounts

This means that all gains you make are subject to taxes, which isn't ideal, especially if this is your main savings, as if you have a significant amount invested, you'll have to pay tax when you withdraw.

InteractiveInvestor

Similarly to Robinhood, i've not used this platform too much, but in my experience it seems decent.

Benefits

- Modern interface

Like Trading212, the interface for II is quite modern, and it is easy to find where everything is.

- Easy to open an account

It was quite easy to open an account, it only took me a few minutes, and most of that was setting up the direct debit.

Downsides

- Subscription cost

It costs £4.99/mo. for the cheapest plan, and you could put that £4.99 into an investment if you use a free platform.

Conclusion

Overall, you can use whichever platform you think is best, I prefer Trading212, but you might have different goals with investing, and decide that Robinhood is better, or InteractiveInvestor is better, it all depends on your goals with investing, and what you're comfortable with.